Tips for Organize Your Financial Records Effectively

Most Americans are obsessed with organization and this tendency is likely to improve. However, there are culture of being clean and ordered life.

It feels good to have a clean house. Similarly, an orderly approach can also help you in managing your finances. It's hard to reach your financial goals if you can't see your finances.

Organizing your finances helps to avoid financial stress and allows you to focus on the important elements of life that are important. In this post, we will find out more about the importance of organizing your finances and how a 3-ring binder can help you achieve this.

The benefits of taking control of your finances

There can be plenty of benefits to taking control and organizing your finances. Though there can be a multitude of benefits, let's find some of them:

-

Know your net worth:

One of the important benefits of organizing your financial life is that it helps you know your net worth. Though the process is a bit tedious, it can be quite rewarding. Once you have a good idea about your net worth, it will help you to:

- Set financial goals for the future.

- Adjusting and creating the budgets.

- Monitor your spendings

- Track your bank accounts, loans, and real estate holdings.

You might be wondering if it's worth the time to gather and consolidate your documents. The answer is yes. It will help you and your loved ones. If you keep bills and accounts in order, it will help your family to find and locate the assets easily.

Having your net worth, account records, and important information in one place helps you control current financial problems and avoid lengthy wealth transfer issues. You will have peace of mind knowing you've done your part to help your family and professionals apply for and claim benefits, close accounts, and pay taxes.

-

Save time and energy:

Keeping your financial records tidy will help you ensure that whenever you need specific information or documentation, you can access them easily and from accessible places. Having a record of important documents and monthly bills at specific locations eliminates hours of searching for misplaced documents. It saves time and effort so that you don't have to find misplaced documents in shoeboxes, drawers, or closets.

-

Organization becomes routine:

A routine is doing the same thing over and over until you don't have to think about it. Organizing is the same. When you go through your mail, don't just throw it on the kitchen counter. Take a minute to put the bills in a special place until you're ready to pay them. This will soon become routine, and you'll be closer to an organized financial life.

-

You feel more energetic:

Once you organize your finances, you'll have more time for the things you want and other projects. You can be more spontaneous because you know your finances are in order. Clearing out the clutter and organizing even one part of your life can be stress-relieving and energizing. Yu can utilize this time by treating yourself by going away for the weekend or plan a family outing.

-

Build confidence:

Once you have streamlined your financial operations, you will have more time to pursue your personal and professional goals. You can better handle unexpected challenges and seize new opportunities. By organizing even, a single aspect of your financial life, you can reduce stress and anxiety and gain a sense of control. Treat yourself to a weekend getaway or plan a family outing.

-

Maximize Your Savings:

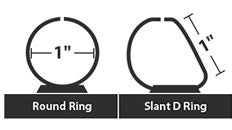

Organizing your finances can also help to maximize your savings. When you maintain accurate records of your expenses, income, and investments, you can learn about the areas where you can reduce costs and save more money. It can better equip you to achieve your financial objectives as you may end up saving a down payment on a house or building your retirement fund. A 3 Ring can help you monitor expenses and identify potential cost savings.

-

Avoid Late Payments and Missed Deadlines:

One of the key benefits of organizing your finances is that it helps you avoid missed deadlines and late payments. It can include items such as bills, taxes, or other financial obligations. Late payments can also lead to penalties and late fees, which can make it difficult to manage your finances. It is where a three-ring binder helps you keep track of bills and deadlines to ensure that you never miss any item.

How can Ring Binder Depot help?

It is crucial to have an accurate, real-time view of your net worth and expenses to determine whether you are on the right track and able to meet your retirement and financial goals. Ring Binder Depot offers essential tools such 3 ring binder for anyone who want to keep track of their finances and avoid misplaced documents. Choosing the right ring binder help you stay top of your financial goals. Order yours today.

For more read click>>>>Why Proper Medical Record Documentation Is Vital

FAQ: Tips for Organizing Your Financial Records Effectively

Q1: Why is organizing financial records important?

Organizing your financial records is crucial for several reasons. Firstly, it helps you gain a clear understanding of your financial standing, including your net worth, assets, and liabilities. Additionally, it allows you to track your spending, create budgets, and monitor your financial progress towards goals. Moreover, organizing your finances can reduce stress, save time, and ensure timely payments, ultimately leading to better financial management and peace of mind.

Q2: What are the benefits of knowing your net worth?

Knowing your net worth provides a comprehensive view of your financial health. It enables you to set realistic financial goals, adjust budgets accordingly, and monitor your spending habits effectively. Moreover, understanding your net worth is essential for long-term financial planning, such as retirement savings and investment strategies.

Q3: How can organizing financial records save time and energy?

Keeping your financial records tidy and accessible saves significant time and effort that would otherwise be spent searching for misplaced documents. By maintaining a systematic organization of important documents and bills, you can easily retrieve needed information whenever necessary, eliminating the hassle of rummaging through cluttered drawers or files.

Q4: How does organization become routine in managing finances?

Establishing a routine for organizing financial documents is key to maintaining long-term financial health. By consistently sorting and storing bills, statements, and other paperwork in designated locations, you can streamline the process and make it a natural part of your daily or weekly routine, ultimately ensuring sustained financial organization.

Q5: Can organizing finances improve energy levels and confidence?

Yes, organizing finances can have a positive impact on energy levels and confidence. Clearing clutter and gaining control over financial matters can alleviate stress and anxiety, resulting in increased energy and motivation to pursue personal and professional goals. Moreover, having a well-organized financial system instills confidence in one's ability to handle unexpected challenges and seize opportunities.